In this first part of the value analysis series, I will cover Total Cost of Ownership (TCO) and why do you need it?.

TCO is an assessment of total cost for a product (hardware/software or even a car) over a the life time of the product.The total cost includes upfront purchase cost + any (hidden) ongoing costs (monthly, yearly) such as maintenance, operational, licensing etc.Understanding the total cost over the lifetime of the product will help you asses the over all value to the business and make apple to apple to comparison to other alternatives much easier.There is a simple exciting formula for calculating TCO.

Are you ready?

TCO = One Time Costs + Recurring Costs x Expected Duration

One Time Costs: Hardware/software purchase cost, shipping, installation, professional services, decommissioning etc.

Recurring Costs: Maintenance, upgrades, annual license fees, support

Expected Duration: The expected life time of the product/service

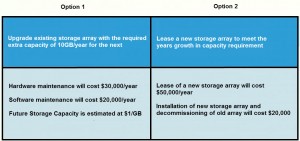

Let me illustrate with an example (see scenario table below):

Company XYZ Corp is evaluating upgrading their current SAN or leasing a new one. They have asked you to calculate both TCO options and make a recommendation.

Option 1:

Costs of Hardware Maintenance: $30,000/year

Costs Software maintenance: $20,000/year

Costs of Storage: $10,000/year

TCO = $30,000 + $20,000 + $10,000 x 5 years = $300,000

$300,000 is the total cost of onwership over the 5 years life time of the upgraded storage array.

Now let us take a look at Option 2

Costs of lease of new storage array: $50,000/year

Costs of installation of new storage array: $20,000

TCO = ($50,000 x 5 years) + $20,000 = $270,000

TCO for option 2 is lower than option 1. Therefore, you should recommend that XYZ Corp select option 2 as it presents a better TCO.

This was a simplified example to illustrate how to calculate TCO. I hope this helps.

Thank you for reading.

Nick

Mike

October 10, 2016Thank you for a great post explaining Total cost of ownership